The UK has fallen head over heels in love with contactless payments. To put it into perspective, shoppers increased spending on contactless cards by 300% in the UK, in the past year.

Annual spending has reached a record £2.32 billion, according to the UK Cards Association and a staggering amount when you remember the spend limit for contactless payment is still pegged at a modest £20.00.

There are now some 58 million contactless cards in circulation in the UK alone – a whopping increase of 51% on last year. So why the soaring popularity?

It’s a safe and secure method of payment, with very little fraudulent activity documented. It’s ideal for consumers on the go who want to pay for that takeaway coffee as quickly and conveniently as possible. It means never having to fumble in your purse or pocket to find the correct change again.

Not surprisingly, London leads the way in contactless payment with nearly 30% of card transactions now contactless, according to Barclaycard’s data.

Contactless payments have also been given a popularity boost due to Transport for London’s policy since September 2014 of banning cash on London buses.

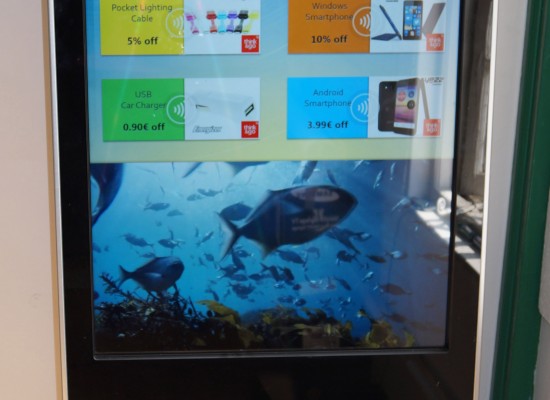

Since banks are now supplying their customers with contactless cards, there are other uses for these useful cards, too. Our Connected Screens are the ideal vehicle for contactless cards, be they Oyster cards, store cards or loyalty cards.

A customer can pick up a discount or special promotion at the touch of a card on the screen. These can then be easily redeemed at the till, when the customer presents the special offer.

Connected Screens are ideal for shopping malls, department stores, supermarkets etc as they build customer loyalty whilst encouraging consumer engagement. The best thing of all is their incredible simplicity – anyone can use them. And that simplicity is what contactless payment is all about.